First Atlantic Bank Marks Five-Award Win with Exclusive Appreciation Cocktail

First Atlantic Bank, a prominent name in Ghana’s banking sector, has solidified its leadership in digital banking by clinching five distinguished awards at the recently concluded Fintech Awards. These accolades reaffirm the bank’s strong commitment to innovation, customer service, and industry excellence.

The highlight of the awards was the bank’s retention of the coveted Digital Bank of the Year title, a recognition it proudly earned for the second consecutive year. This achievement underscores First Atlantic Bank’s relentless pursuit of excellence in the rapidly evolving digital financial landscape.

To commemorate this monumental success, First Atlantic Bank organized an exclusive cocktail event on March 7, 2025, at a prestigious location in Accra. The event was a grand celebration of the bank’s achievements and provided a platform for staff, loyal customers, and key industry stakeholders to come together and celebrate the bank’s ongoing success. The evening was filled with vibrant music, delectable food, and meaningful networking opportunities, all set against a backdrop of gratitude and appreciation for the people who have contributed to the bank’s success.

Beyond the Digital Bank of the Year title, First Atlantic Bank also earned recognition in several other categories, including Mobile App of the Year (for FAB Mobile), Innovative Product of the Year (for Corporate Internet Banking), Fintech Bank Partnership of the Year, and the prestigious CIO of the Year award, which was presented to Franklin Johnson Gbedzi, the bank’s Chief Information Officer.

These awards are a testament to the bank’s exceptional contributions to the digital banking ecosystem in Ghana. Over the past year, First Atlantic Bank has introduced a series of innovative digital solutions aimed at transforming the customer experience and enhancing financial accessibility. For instance, the bank launched microloans for Mobile Money agents to promote financial inclusion and ease the financial burdens of local entrepreneurs. The seamless functionality of the FAB Mobile app and the robust features of Corporate Internet Banking are just a few examples of how the bank has continually set new standards in financial technology.

The bank’s ongoing strategic fintech collaborations have also been instrumental in driving innovation and expanding access to digital financial services across Ghana. These collaborations have allowed First Atlantic Bank to extend its digital footprint and contribute to the broader goal of increasing financial inclusion within the country.

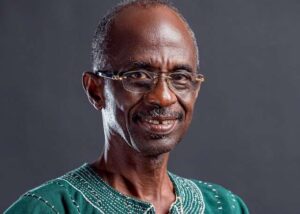

In his address at the event, Mr. Armah Amarquaye, the Board Chairman of First Atlantic Bank, expressed immense pride in the bank’s accomplishments, stating that one of their strategic goals has always been to position the bank as Ghana’s premier digital banking institution. He noted that the recognition received at the Fintech Awards is proof that the bank is on the right track and that their vision for a digitally-driven financial ecosystem is coming to fruition sooner than expected.

“The outcome of these awards reaffirms that we are indeed ahead of schedule in achieving our goal,” Mr. Amarquaye remarked. “We are committed to furthering the growth of digital banking in Ghana and continuing to provide innovative solutions that empower our customers and contribute to the nation’s economic development.”

The celebration held on March 7 was not just a moment of reflection on the bank’s accomplishments but also a celebration of its digital evolution and a reaffirmation of its ongoing commitment to customer satisfaction. It was an evening that embodied the essence of First Atlantic Bank’s mission: to offer cutting-edge banking solutions while ensuring the well-being of its clients.

With inspiring speeches from the bank’s leadership, a highly engaged audience, and a clear focus on the future, the cocktail event served as a symbolic milestone in First Atlantic Bank’s journey toward becoming a cornerstone of digital banking in Ghana. Looking ahead, the bank is poised to continue its trailblazing journey in the digital space, delivering more innovative products and services to better serve its customers and the Ghanaian economy.