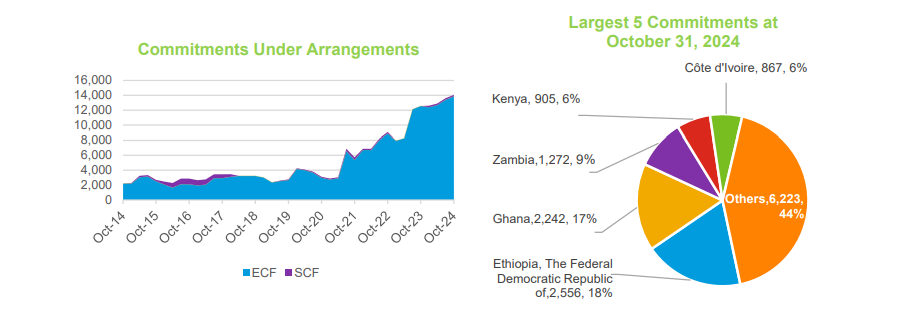

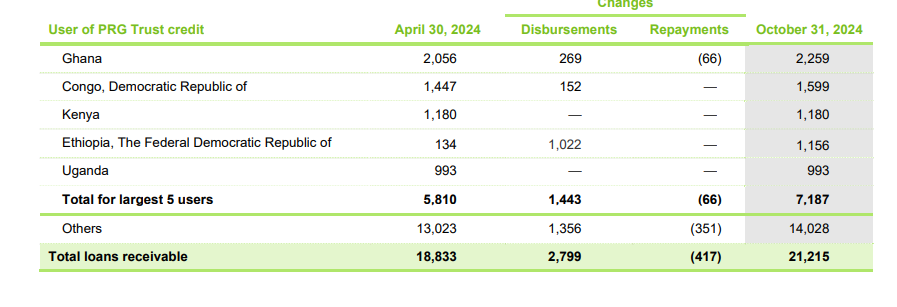

Ghana is the second most indebted country in Africa to the International Monetary Fund (IMF) when it comes to concessional lending and debt relief. As of October 31, 2024, the country’s exposure to the IMF amounted to 2.242 billion Special Drawing Rights (SDR), which is roughly equivalent to $2.914 billion. Until recently, Ghana held the title of the most indebted African country to the IMF, but this position has now been surpassed by the Democratic Republic of Congo (DRC), which currently holds the highest indebtedness in the region.

Ghana’s exposure to the IMF represents 17% of the total borrowings from the Fund across Africa, reflecting the significant level of debt faced by the West African nation. The DRC leads the list with an indebtedness of $2.256 billion SDR to the IMF, while Zambia follows in third place, with 1.272 billion SDR in outstanding loans. Both Ghana and Zambia have experienced financial difficulties, which have led them to default on their loans and subsequently seek assistance from the IMF.

The rising levels of debt are a concern for Ghana, with the country’s outstanding concessional loans to the IMF increasing compared to figures from July 2024. This growing exposure highlights the nation’s ongoing struggle to manage its finances and maintain economic stability. Ghana’s debt situation became critical in the aftermath of various economic challenges, including rising inflation, currency depreciation, and fiscal imbalances, which put immense pressure on the country’s financial system.

In response to these challenges, Ghana turned to the IMF in January 2023, requesting economic support to help stabilize its economy. The IMF’s intervention came in the form of a $3 billion bailout package, approved in May 2023, designed to revive the Ghanaian economy and address the underlying issues that contributed to the country’s financial crisis. This agreement was a pivotal moment in Ghana’s economic recovery efforts, providing the country with much-needed resources to implement fiscal reforms and support critical sectors.

So far, Ghana has received $1.92 billion from the IMF under the Economic Credit Facility Program, which is part of the broader $3 billion package. These funds have been used to address various aspects of the country’s economic recovery, including stabilizing the currency, reducing inflation, and implementing structural reforms aimed at improving fiscal management. The support from the IMF is seen as a lifeline for Ghana, helping to restore investor confidence and promote long-term economic growth.

Despite the challenges posed by its high levels of indebtedness, Ghana remains focused on implementing the necessary reforms to stabilize its economy. The IMF’s assistance has provided the country with a crucial opportunity to address fiscal imbalances, improve public sector management, and promote sustainable growth. However, the nation’s high level of debt to the IMF serves as a reminder of the importance of maintaining sound fiscal policies and managing debt levels to avoid future financial crises.

Ghana’s position as the second most indebted African country to the IMF underscores the significant financial challenges the country faces. While the IMF’s bailout package offers some relief, the country’s ability to manage its debt and implement effective reforms will be critical to its economic recovery. The lessons learned from Ghana’s debt crisis will be important for other African nations as they navigate their own economic challenges and seek to maintain fiscal stability in an increasingly complex global financial environment.