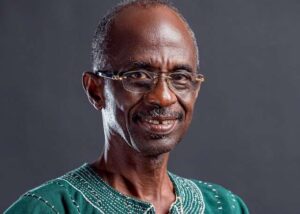

Professor Seidu: Removal of Betting Tax Boosts Government’s Political Score

Prof. Seidu Weighs in on Betting Tax Removal and Youth Employment in Ghana’s 2025 Budget

Professor Alidu Seidu, the Head of the Political Science Department at the University of Ghana, Legon, has provided his insights into the government’s recent decision to remove the controversial betting tax in the 2025 Budget. He believes that this move offers the government a significant political advantage, providing a “good scorecard” in the short term. However, while he acknowledges the political gains, he also stresses that the government must look beyond such measures and focus on addressing deeper, long-term issues such as youth employment.

In an exclusive interview with the Daily Graphic on Wednesday, Prof. Seidu praised the government’s responsiveness in fulfilling its promise to abolish the betting tax, recognizing it as a political victory that aligns with the government’s commitment to following through on its budgetary pledges. He acknowledged that the move was likely to garner favorable reactions from certain segments of the population, particularly those who view the tax as a burden. Nevertheless, he urged that the removal of this tax should not be seen as a panacea for the country’s broader economic challenges.

However, the professor also expressed concern over the moral and social consequences of betting, which he believes could outweigh the immediate political gains. He explained that while many people view betting as a form of entertainment, it is also highly addictive. Betting, according to him, can encourage risky behavior and a false perception that wealth can be easily acquired without effort, which could erode the moral values of society. Prof. Seidu pointed out that this issue should not be dismissed lightly, especially in a country where the younger generation is increasingly drawn to quick-fix solutions for financial success.

In light of these concerns, Prof. Seidu called for the government to consider the long-term implications of encouraging gambling. He emphasized that the youth must be provided with viable alternatives to channel their energy into more productive and sustainable avenues. While the betting industry is profitable and could contribute to government revenue, he warned that it may lead to social issues such as addiction, mental health struggles, and financial instability, which could burden the nation in the long run.

On the broader topic of youth employment, Prof. Seidu was firm in his belief that the government needs to take more proactive steps to create sustainable job opportunities. While he acknowledged that the removal of the betting tax might be a short-term relief for some, he argued that the real challenge lies in providing young people with meaningful employment options. With Ghana’s high unemployment rate, he believes that the government must shift its focus toward developing robust youth employment policies. This could include incentivizing startups, encouraging innovation, and providing the necessary infrastructure to support entrepreneurial endeavors.

Such initiatives, Prof. Seidu argued, would help build a more resilient economy and reduce the dependency on short-term solutions like gambling. He highlighted that while betting may offer temporary financial relief for some individuals, it ultimately does little to foster long-term economic growth or stability. Instead, empowering the youth with skills and resources to pursue entrepreneurship or gainful employment would be more beneficial for the nation’s future.

Turning to other taxes, Prof. Seidu discussed the government’s approach to what he referred to as “nuisance taxes,” including the E-levy. He criticized these taxes for being burdensome, especially in the context of Ghana’s ongoing economic challenges. He expressed concerns that such taxes place undue pressure on ordinary citizens, further straining the country’s governance framework. However, he acknowledged that the Finance Minister, Cassiel Ato Baah Forson, had introduced measures to increase internal revenue generation, which could help mitigate potential funding gaps created by the removal of taxes like the betting tax.

Prof. Seidu concluded by reiterating the importance of job creation as a central pillar of the government’s economic strategy. He argued that while tax policies and other financial measures are important, they cannot substitute for a solid plan to reduce unemployment and promote sustainable development. He also noted that the Ghanaian electorate has become more politically astute and would not hesitate to hold the government accountable if it failed to deliver on its promises.

Finally, regarding the ruling National Democratic Congress (NDC) and its ability to fulfill its manifesto promises in the first 120 days of office, Prof. Seidu remained cautiously optimistic. He acknowledged that while it may not be feasible to achieve all objectives within such a short time frame, the government’s early actions were encouraging. He expressed confidence that, even if not all promises were fulfilled in the immediate term, the government could still address key priorities over the course of its four-year tenure.